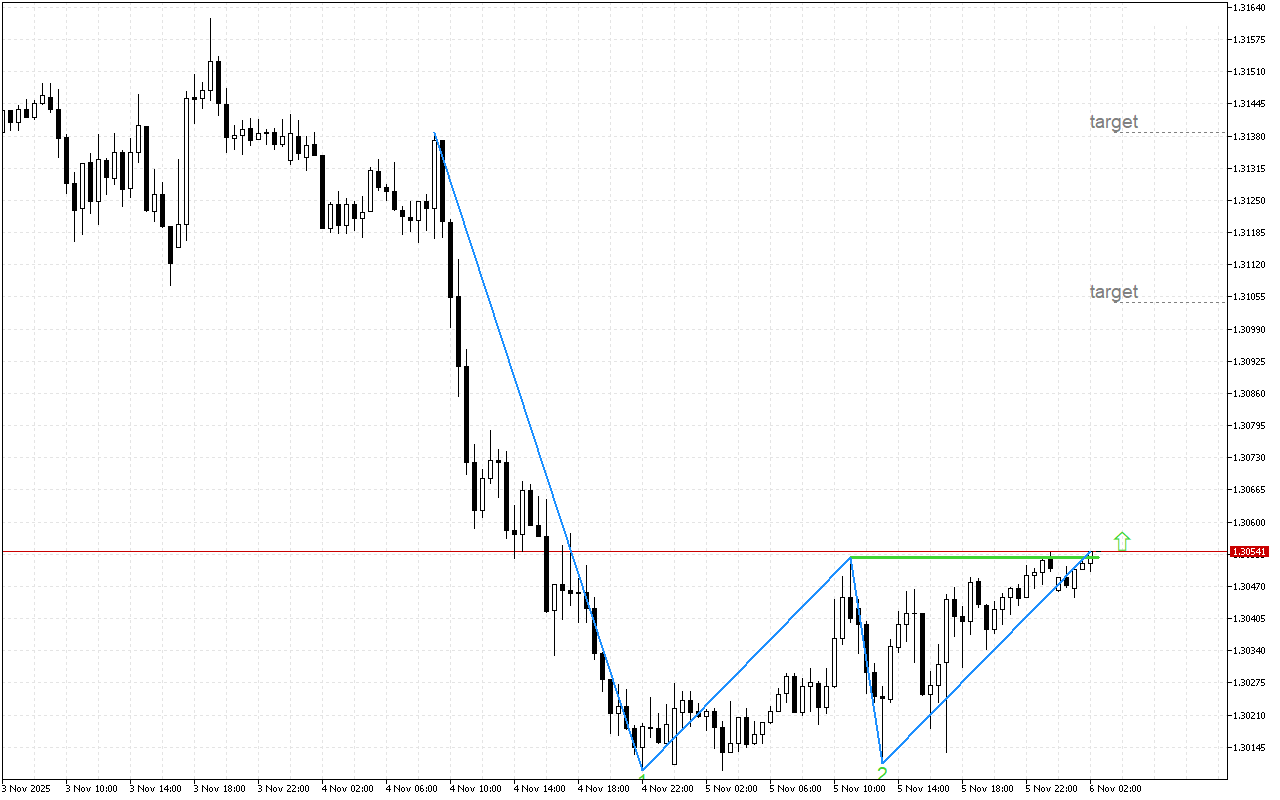

In the current timeframe, there is a decrease in the selling interest. This may lead to the reversal of GBPUSD.

A Double Bottom pattern is being formed on the chart. The key element to confirm the pattern is the breakdown of the neck line, which is drawn through the high points between the two troughs at the level 1.30528. The first scenario assumes that the price will consolidate above the neckline and continue to move upward, confirming the reversal. In the second scenario, a pullback below the neckline is possible.

Thus, based on GBPUSD, it is recommended to focus on opening long positions. The market entry point is warranted at the current level or upon the retest of the support level.

📌 Entry: 1.30541

✔️ First target: 1.31044

✔️ Second target: 1.31388

❌ Stop order: 1.30098

GBPUSD M30: The Double Bottom pattern indicates a possible change in the direction of price movement