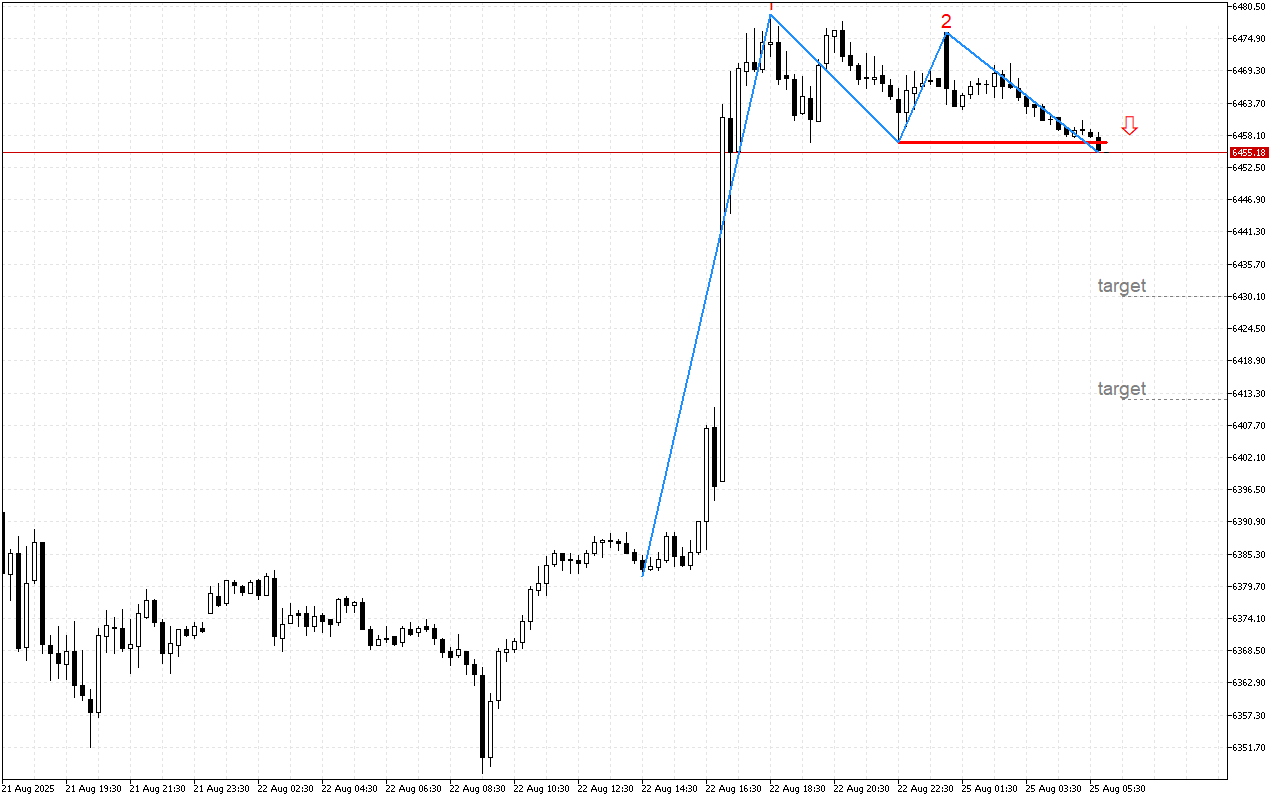

The S&P 500 pattern revealed on the chart indicates weakness in upward momentum.

The formation of a classic Double Top reversal pattern is observed on the chart. The main signal for confirmation of the pattern is the breakthrough of the neckline, which was drawn through the minimum between the two peaks at the level 6456.81. Now the price has broken through this line, which confirms the reversal nature of the pattern.

Short positions should be prioritized to trade S&P 500. A trader can enter using the current price levels or, alternatively, it can be done after a retest of the resistance level.

📌 Entry: 6455.20

✔️ First target: 6430.06

✔️ Second target: 6412.23

❌ Stop order: 6479.10

S&P 500 M15: The price completes the formation of a reversal signal for this pattern